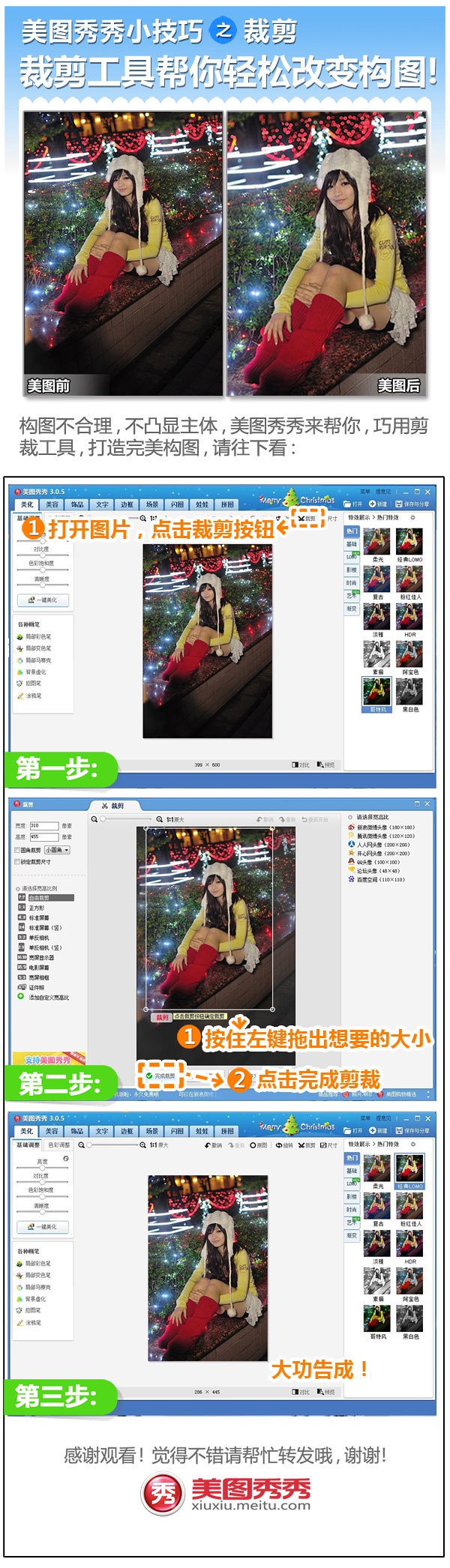

Aug 23, 2016 Meitu’s flagship selfie app Meitu Xiuxiu is a simple-to-use free photo editing and sharing tool, with one-touch beautifying features including skin whitening, eye enlarging, and jawline thinning. 美图手机 美图美妆 闪聊 美图日记 美美小店 万能相机 美图秀秀 美图秀秀网页版 贝客钱包 海报工厂 美拍 火星文输入法 安卓软件园 火车时刻表 美图秀秀网页版 刷机精灵 欣欣旅游网 搞笑QQ表情 wed114美图写真 谷歌265导航 多特软件站 IT之家 软媒魔方 桌面壁纸 返.

There’s a joke going around in Chinese internet circles, “Even a pig can fly, if it is in the middle of a whirlwind”. Meitu Inc., which has taken to the skies assisted by the whirlwind of “photo beautification”, is a typical example.

Meitu Inc. started as a photo-beautification APP company in 2008 with its Meitu Xiuxiu App, and gradually expanded its business and product lines to Apps like Beauty Camera, Meipai Video, ultimately launching a Meitu-branded smartphone. After eight years of development, Meitu Inc. successfully went public in December 2016 at the Hong Kong Stock Exchange with an estimated valuation of USD 5 billion.

Meitu product line, from public sources

By the time when Meitu Inc. went public in Hong Kong, despite the positive outlook on the future potential of the company from investors, it had been suffering massive losses for three consecutive years, amounting to over CYN 1 billion (USD150 million).

By the end of 2017, Meitu Inc. had successfully fixed its position as the leading company in photo and video beautification—earning over 400 million MAUs globally. Nevertheless, despite the sizable MAU base, Meitu Inc. still failed to achieve profitability, ending CY 2017 with a net loss of over RMB 45 million (US$7 million).

Source: Meitu Inc. 2017 Annual Report

Analysis of Meitu’s Core Product Offerings – What has Worked and What hasn’t

Looking at the core products of the company—Meitu Xiuxiu, Beauty Camera and Meipai, the monetization capability of the products is relatively weak. Smartphones, which bring the highest revenue, is relatively a side-line, rather than a core business of Meitu. Since the competitive strength of Meitu is photo & video beautification technology, instead of hardware, it’s very difficult for the company to scale its hardware business which targets niche market only. Moreover, compared with smartphone companies like HOVX, Meitu Inc. doesn’t have the financial power to invest in R&D or marketing which are essential for the sustainable development of hardware business. Thus, currently, the business model of Meitu Inc. which has to rely on hardware to drive revenue, is fragile.

Meitu Xiuxiu and Beauty Camera:

- Meitu Xiuxiu and Beauty Camera, the core products of Meitu Inc., from inception were referred to as “tools”. With “utility” being the key DNA of the products, channels to generate revenue are limited, as users wouldn’t spend much time in Meitu apps compared with other platforms. This could have been avoided with better social media integrations if Meitu had focused on community-building with its app ecosystems.

- Current Meitu users use its apps to take or modify pictures, and then directly go to social media platforms to share the pictures. From an advertiser’s perspective as well, spending marketing money on social media or content sharing platforms would gain better brand exposure compared to Meitu, where users don’t spend a lot of time.

- Apart from advertisements, it is difficult for Meitu Xiuxiu and Beauty Camera to bring revenue to the company from other channels. In addition, with the proliferation of photo beautification apps from other companies, all of which offer free services to users, it is difficult for Meitu to transition to a paid model, since user stickiness for ‘utility’ applications is normally low.

Meipai:

- According to the 2017 annual report of Meitu Inc., around 17.4% of the revenue is from internet services, and we estimate that most of its internet revenue is from Meipai, the video sharing & streaming platform from Meitu Inc.

- Numbers regarding Meipai seem impressive: By end of 2017, Meipai had accumulated over 98 million MAUs (-13.8% YoY growth) generating USD 100 million (+652% YoY growth) revenue. Yet in comparison, another video streaming & sharing platform “Inke” in 2017 generated around USD600million from only 25 million MAUs. In terms of revenue generated per MAU, Inke :Meipai is around 24:1. The monetization capability of Meipai is also weak compared with other video sharing platforms.

- Meipai, established in 2014, was an early entrant to the video beautification and sharing market. Yet since the DNA of Meitu Inc. was geared towards “utility” instead of “community building”, Meitu, in the first few years, focused on the traditional advertisement-driven business model, instead of building Meipai into a social and content sharing community like YY Inc. or Inke.

- Meipai didn’t enter the video streaming business until 2016, when YY Inc, Inke, Weibo Yizhibo, Kuaishou and other players, had already entered the market. Simply said, Meipai missed the “easy money” stage in China’s video streaming market which was before its year of entry (2016).

- In 2017, the competition in China’s video streaming market is fiercer with new entrants aggressively tackling the market. New entrants include iXigua and Tik Tok (Chinese version of Musical.ly under Byte Dance, the Chinese internet giant which also acquired Musical.ly). By end of 2017, in terms of app penetration, Meipai with a market share of 4.3% is ranked at no. 2 in China.

- However, due to the fast-changing nature of the video streaming market in China, today’s leader could be surpassed by a newcomer next month. In 2018, TikTok and iXigua are expanding fast with aggressive investments in offline marketing campaigns. Given the financial capability of Byte Dance, it is difficult for their counterparts, even Meitu Inc., to compete in this money-burning war. The increasingly fierce competition is presenting great challenges for Meipai to maintain its leadership position as well as to grow its revenue in the video streaming sector.

Meitu Smartphone:

- Around 80% of the company’s revenue is generated from the hardware sector, represented by the Meitu smartphone. The Meitu smartphone is targeting the niche market, e.g. stars, or women who are heavy selfie takers. It has adopted a “hungry marketing” strategy as Meitu has limited the supply of phones to the market.

- Meitu smartphone, though positioning itself as a selfie “smartphone”, is competing against cameras such as the Casio TR 750 (which in China is well-known as “magical selfie-taking tool”), instead of smartphones. With the attractive price of Meitu smartphone under CYN 2,500 (USD 400), its advantage in affordability is quite clear compared with the Casio TR 750, which is priced over CYN 6,000 or USD 800.

- Moving forward, with more smartphone brands able to offer advanced photography tech to users such as AI powered cameras, the growth potential of Meitu smartphone is expected to be limited.

SWOT Analysis on Development Outlook of Meitu Inc.—can it break through the development bottlenecks to achieve future profitability?

Strengths:

Meitu Xiuxiu Download

- Positive indicators from Meitu’s 2017 annual report include the impressive growth in total revenue (+186.8%) leading to the reduction in net loss (-91.5%), which implies improvement of the company in monetization capabilities.

- Meitu Inc. has established a well-known brand across China and other Asian countries, as the leading player in the photo beautification space.

- Over 80% of the hundreds of millions of MAUs on Meitu platform are female. with the user base and user data, Meitu has the opportunity and the data to develop and succeed in businesses targeted at women.

- Breaking down the MAUs of Meitu by geography, around 10% of the users are from overseas countries in Asia. Following the growing internet penetration in India and South East Asia, Meitu still has great development opportunities outside of China, to offset any potential loss in the Chinese market.

Weaknesses:

- Meitu Inc. is still relatively weak in monetization capability as mentioned;

- Corporate management: After having gone public, the number of Meitu employees grew from 50 in 2013 to over 500 in 2016. Organization and management problems have soon followed the rapid expansion of the company, challenging the young management group who lack experience in managing big companies, and thereby negatively influencing the overall operation and growth of the company.

- Talent acquisition: As the headquarters of Meitu is in Xiamen instead of top-tier cities such as Beijing, Shanghai and Shenzhen, it could be more difficult for the company to attract the best talent.

Opportunities:

- Growth potential of selfie APP business in China: Selfie apps that users can use to liven-up their photos by attaching stickers and trying special make-up effects are still very popular in China and other Asia countries, especially among young people and teenagers. Thus, the MAUs of Meitu Xiuxiu enjoyed a healthy YoY growth of 14.8% in 2017.

- Growth potential of the blooming video streaming industry: we still see an immense growth potential for video streaming platforms, following the increasing population from generation-after-2000 or Gen-Z growing-up to become internet users in China.

Threats:

Meitu Xiuxiu Pc

- The improving camera quality in smartphones is a potential threat to the future survival of the key products of Meitu Inc., including Meitu Xiuxiu, Beauty Camera and its own brand smartphone. Meitu Inc. will have to develop more users in overseas emerging markets and meanwhile ride-on the current female user base in China to create new business opportunities.

- Decreased market share in the highly competitive video streaming market in China after big players have joined the competition: after Tik Tok and iXigua came to the market in 2017, Meipai suffered over 13% of loss in MAUs. As mentioned above, Tik Tok and iXigua are growing more aggressively this year, and it’s difficult for other players to join the money-burning war.

- Stricter government policy on UGC platforms: At the end of 2017, the Culture Department of China required Meipai and other UGC platforms to impose stricter scrutiny on users and content. Government has the right to close the platform anytime for breach of regulations.

Weighed-down by these challenges, Meitu Inc. has been taking actions to try to troubleshoot the problems. Last November, Meitu hired Bryan Cheng as COO to head corporate monetization. Before joining Meitu, Cheng served as an SVP for Sina Weibo and had headed major monetization projects of Sina Weibo since 2012. Furthermore, for the better development of key product Meipai, Meitu Inc. moved the entire Meipai team from Xiamen to Shanghai earlier this year. The company has integrated a social network platform in Meitu Xiuxiu version 8.0 in April; now it is making efforts to catch up in social network operation and investing in AI technologies to innovate and bring a fresh user experiences across its portfolio of applications.

For Meitu, the “whirlwind” period is gone; now it needs to fight to survive in the “headwind”.